Recent years have seen significant growth in the HVAC business for sale owing to increasing demand not only from homes seeking comfort systems but also commercial climates as well. Entrepreneurs and business owners who have been so successful in turning around the company are learning that selling an HVAC company means dealing with much more than simple listing of assets—it takes market know-how and a network of professionals, and working with an experienced hvac business broker can make all the difference. At Brentwood Growth, we help owners to understand the details of this process ensuring a smooth transition with highest possible value. Whether you’re considering retiring, reinvesting, or opening a new market, understanding the market is vital to success.

Why the HVAC and Roofing Market is So Attractive

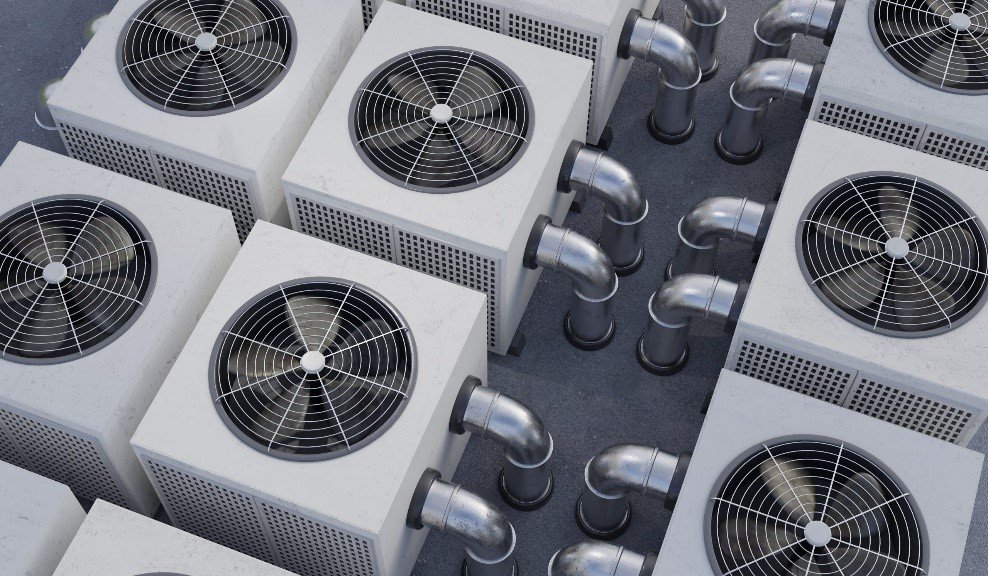

During economic swings, the HVAC and roofing sectors still maintain their previous grace. Households and corporations alike make investments in climate control, which means companies in this field are highly sought after for sale. Well-run companies with strong client lists, reliable workforces, and good modern equipment attract not only local buyers but national investors looking for dependable income streams.

The demand for roofing companies often peaks after heavy storms or when there is much do-it-yourself home renovation going on prior, providing an opportunity to sell roofing company or set up roofing business for sale. HVAC businesses are equally attractive to buyers because of stable demand, ongoing maintenance contracts, and strong local market reputation.

Getting Ready to Sell Your Business

Selling an HVAC and/or roofing business is not just something to be handled casually. Before you hang out your shingle, make sure that all financial records, client contracts, and operations information are in order. Buyers will look for openness and consistency. Presenting these items in a professional way can bring in a lot of money at the final sale price.

Key steps include:

- A thoroughgoing financial audit to check over revenues and expenses

- Updating and organizing customer service contracts to ensure continuity and appeal to buyers

- Looking at the structure of your workforce and implementing employee switching plans

What Factors Distinguish a Good Business Broker?

One of the most effective means by which to sell your business is through an enterprise brokerage. Not only can they provide market intelligence, but also introduce you to qualified buyers and assist with negotiations whilst maintaining confidentiality. Within their field of expertise comes assurance that your enterprise is presented correctly; this approach attracts serious buyers.

A broker can also help with:

- Determining market value on comparable sales

- Structuring deal terms and payment options

- Overseeing any necessary legal or regulatory compliance

This way, owners can continue to operate on a day-to-day basis while brokers take care of all the complexities of a sale.

Valuation and Market Trends

Inquiry into the current business climate is crucial when pricing an enterprise. HVAC market growth is being spurred by today’s higher standards for energy efficiency, smart home technology, and commercial development. Companies that include maintenance contracts, retained earnings, or special services have a higher valuation.

As well, the roofing industry is benefiting from growing public awareness of sustainable materials, storm-tight technology improvements, and grants from government programs for energy-efficient architecture. By clearly highlighting these trends in your business’s profile, you can improve perceived value and attract buyers looking for long-term growth.

Legal and Tax Considerations

There are many legal and tax ramifications to be considered when selling a business. With the help of experienced professionals, it’s possible to bypass every potential problem while staying within federal and state requirements to keep future taxes low. Drawing up airtight purchase agreements, negotiating assets, and handling employee contracts are all essential items that require professional input.

Working with a team that includes accountants, attorneys, and business brokers, the seller can protect his interests, keep buyers confident of the reliability of his product, and close a deal. Proper documentation is essential for any HVAC business for sale or sell roofing business transactions.

Strategies for Selling HVAC and Roofing Businesses

If you are looking for hvac companies for sale or a roofing business, the way it’s positioned is vital. Emphasize good client relationships, a trained staff, and coverage area to increase attractiveness. Marketing must highlight:

- Positive client testimonials and case studies

- In-depth operational manuals and training programs

- Expansion or diversification possibilities

- Stability in finance and steady growth

Brentwood Growth works with management to obtain business profiles pitched to the right buyers, ensuring a smooth transition and successful sale.

Post-Sale Transition

A successful sale is not complete at closing. Supporting the period of transition is essential to the satisfaction of customers and the good standing of your firm. Often buyers prefer the seller to stay involved briefly so that they can train staff, introduce important clients, and give guidance in operations. This cooperation guarantees continuity and often leads to a more profitable outcome.

Final Thoughts

Selling an HVAC business or roofing contractor may be one of the most deeply rewarding experiences for a professional. Every step, from preparation through negotiation and post-purchase transition, is crucial for your company’s maximum value. Companies that want to sell HVAC business or sell roofing business must take advantage of professional resources, market insight, and trusted networks.

For those wishing to explore options, relying on a seasoned broker like Brentwood Growth offers swift, clear, and profitable transactions. Whether it’s construction, HVAC, roofing, or a service-based company, with proper planning and expertise, a simple sale can become a strategic opportunity for growth and reintegration.

Leave a Reply